Building Financial Confidence Through Understanding

We started biroxanvara because too many people felt overwhelmed by financial decisions. Our mission is simple: make financial analysis accessible, practical, and genuinely useful for everyday life.

From Personal Struggle to Educational Mission

Back in 2019, I was helping a friend figure out whether refinancing their mortgage made sense. We spent hours with spreadsheets, trying to make sense of interest rates, fees, and payment schedules. That's when it hit me—if someone with a finance background was struggling to explain this clearly, imagine how overwhelming it must be for everyone else.

"Financial literacy shouldn't require a degree in economics. It should be as straightforward as following a recipe or learning to drive a car."

We launched biroxanvara with a different approach. Instead of theoretical frameworks, we focus on real scenarios. Instead of complex formulas, we break things down into logical steps. Our students work with actual case studies—analyzing business investments, personal budgeting challenges, and market trends that matter in 2025.

What surprised us most was how quickly people gained confidence once they understood the fundamentals. Within months, our early learners were making more informed decisions about everything from retirement planning to small business investments.

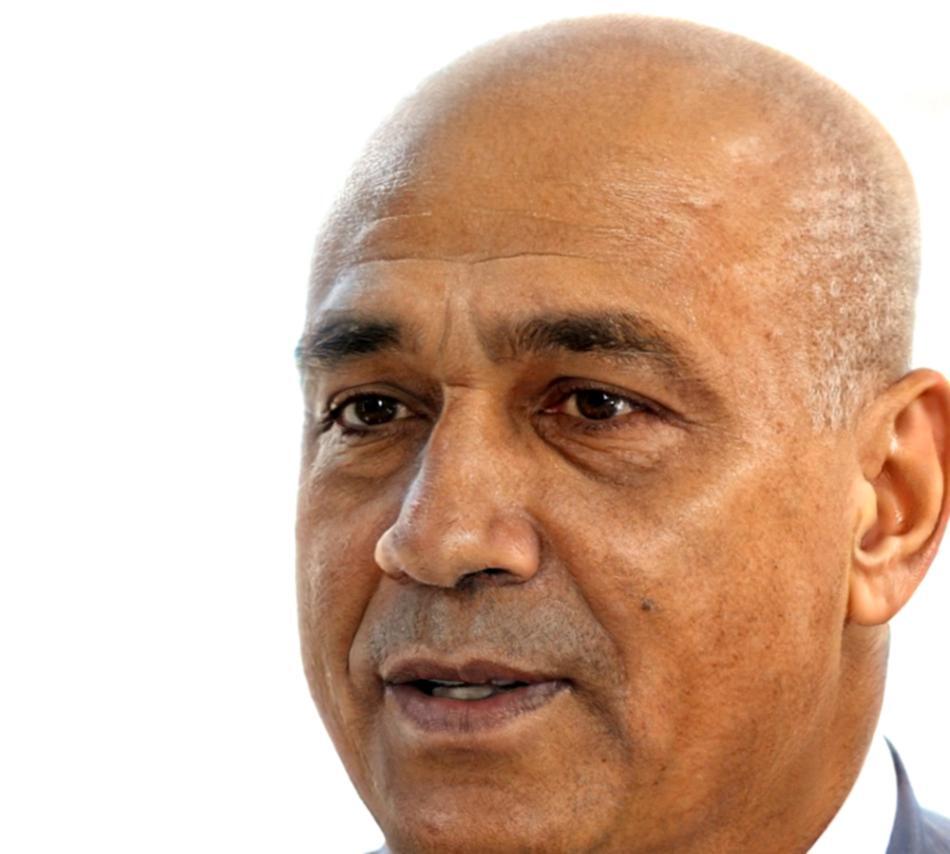

Marcus Chen

Lead Financial Educator

Teaching Through Real Experience

Marcus brings fifteen years of financial consulting experience to biroxanvara. Before starting the platform, he worked with small businesses across Newcastle, helping them understand cash flow, investment opportunities, and risk management. What he learned was that most financial education missed the mark—it was either too academic or too superficial.

Our teaching philosophy centers on practical application. Every concept we cover connects directly to decisions our students will face. Whether you're evaluating a job offer with stock options, considering a property investment, or planning for career changes, we focus on skills you'll actually use.

We keep our program sizes small deliberately. With maximum class sizes of twelve students, Marcus can provide individual feedback and adapt lessons based on real questions and challenges that come up. This isn't a lecture hall experience—it's more like having a knowledgeable mentor walk you through complex decisions step by step.

What Makes Our Approach Different

We've refined our methodology through six years of teaching and hundreds of successful students. Here's what we've learned works best for building lasting financial confidence.

Case-Based Learning

Every lesson starts with real scenarios our students might encounter. We analyze actual financial statements, evaluate genuine investment opportunities, and work through budget challenges using real numbers from Australian markets and businesses.

Progressive Skill Building

We start with fundamental concepts like reading financial statements, then gradually build toward complex analysis like risk assessment and investment evaluation. Each skill builds naturally on the previous one, preventing that overwhelming feeling many people experience.

Industry-Current Content

Financial markets change constantly. Our curriculum reflects current interest rates, recent regulatory changes, and emerging investment options like cryptocurrency and ESG funds. Students learn with data and examples from 2024 and 2025, not outdated textbook scenarios.

Ongoing Support Community

Learning doesn't stop when classes end. Our graduates stay connected through quarterly market analysis sessions and have access to Marcus for questions about specific financial decisions they're considering. Many students return years later for advanced workshops.